Embark on a journey through the realm of Progressive Commercial Auto Insurance: A 2025 Review, where cutting-edge technology meets unparalleled customer service to redefine business insurance. As we delve into the intricacies of this dynamic landscape, prepare to be enlightened and intrigued by the evolution of commercial auto insurance in the upcoming years.

In the following paragraphs, we will uncover the essential aspects of Progressive's offerings, from key features to competitive positioning, painting a vivid picture of what the future holds for businesses seeking comprehensive coverage.

Overview of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers comprehensive coverage tailored specifically for businesses with vehicles. The key features and benefits include:

Target Market

Progressive Commercial Auto Insurance is designed for businesses of all sizes that rely on vehicles for their operations. This includes small businesses, mid-sized companies, and large corporations in various industries.

Coverage Options

- Liability Coverage: Provides protection in case your business is held responsible for injuries or property damage caused by a vehicle.

- Collision Coverage: Covers the cost of repairs or replacement if your vehicle is damaged in a collision.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers damages if your vehicle is hit by a driver who does not have insurance or enough coverage.

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers in case of an accident.

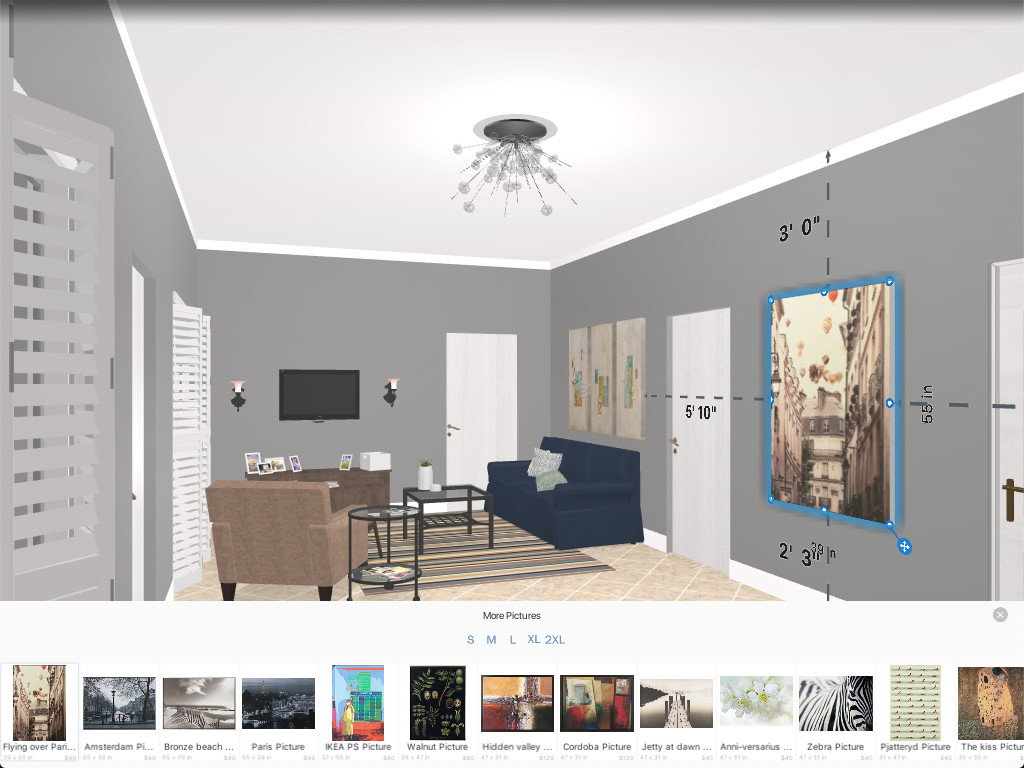

Technology Integration in Progressive Commercial Auto Insurance

In the ever-evolving landscape of the insurance industry, technology plays a crucial role in enhancing efficiency, accuracy, and customer experience. By 2025, insurance companies have significantly embraced various technological advancements to streamline their operations and provide better services to their clients.Progressive has been at the forefront of integrating cutting-edge technology into its commercial auto insurance offerings.

The company has leveraged technology to improve risk assessment, claims processing, and overall customer satisfaction. Through the use of data analytics, telematics, and artificial intelligence, Progressive has transformed the way commercial auto insurance is managed and delivered.

Telematics and Usage-Based Insurance

Progressive has implemented telematics devices in commercial vehicles to track driving behavior, such as speed, braking, and mileage. This data is then used to offer usage-based insurance policies, where premiums are based on actual driving habits rather than generalized risk factors.

This not only incentivizes safe driving but also allows businesses to save on insurance costs.

Digital Claims Processing

Progressive has introduced digital platforms and mobile apps that allow commercial policyholders to report and track claims in real-time. Through these digital channels, businesses can submit photos, videos, and other relevant information directly to the claims department, expediting the claims process and reducing paperwork.

Artificial Intelligence in Underwriting

By incorporating artificial intelligence algorithms in underwriting processes, Progressive can analyze vast amounts of data quickly and accurately to assess risks and determine appropriate premiums for commercial auto insurance policies. This ensures fair pricing and personalized coverage for businesses of all sizes.

Automated Fleet Management

Progressive offers fleet management solutions that utilize automation to monitor vehicle performance, maintenance schedules, and driver behavior. By integrating these technologies, businesses can optimize their fleet operations, reduce downtime, and enhance overall safety on the road.

Customer Experience and Support

Progressive has always prioritized customer experience and support for their commercial auto insurance customers, aiming to provide a seamless and efficient process for businesses in need of insurance coverage. From dedicated customer service representatives to innovative digital tools, Progressive has implemented various initiatives to enhance customer satisfaction.

Customer Service Initiatives

- Progressive offers a 24/7 claims reporting service, allowing businesses to file claims at any time of the day.

- Their customer service team is known for being responsive and helpful, guiding businesses through the insurance process with ease.

- Progressive provides online account management tools, enabling businesses to access policy information, make payments, and track claims conveniently.

Claims Process for Businesses

- Businesses insured under Progressive Commercial Auto Insurance can report claims either online, over the phone, or through the mobile app.

- Once a claim is filed, Progressive initiates an investigation to assess the damages and determine the coverage applicable to the business.

- Progressive aims to expedite the claims process to minimize downtime for businesses, ensuring quick resolution and payment for damages.

Feedback from Businesses

- Many businesses have praised Progressive for their responsive customer service and efficient claims handling process.

- Business owners appreciate the ease of filing claims and the quick response from Progressive's team, allowing them to focus on running their operations smoothly.

- Overall, businesses have reported positive experiences with Progressive Commercial Auto Insurance, citing reliability and support as key factors in their satisfaction.

Competitive Landscape in 2025

In 2025, the commercial auto insurance sector is highly competitive, with insurance providers constantly striving to offer the best coverage, pricing, and customer service to attract and retain customers. Let's take a closer look at how Progressive's commercial auto insurance offerings compare with its competitors and the emerging trends in the industry.

Comparison with Competitors

- Progressive offers a wide range of commercial auto insurance coverage options tailored to businesses of all sizes, including liability, comprehensive, and collision coverage. Competitors such as State Farm and Geico also provide similar coverage but may have different pricing structures.

- When it comes to pricing, Progressive is known for its competitive rates and discounts for safe driving and bundling policies. However, competitors like Allstate and Nationwide may offer different discounts or incentives to attract customers.

- In terms of customer service, Progressive has invested in technology to streamline the claims process and provide 24/7 support. Other competitors like Farmers and Liberty Mutual may have different customer service approaches but aim to offer quick and efficient claim resolution.

Emerging Trends in Commercial Auto Insurance

- By 2025, emerging trends in the commercial auto insurance sector include the increasing use of telematics and data analytics to assess risk and personalize pricing for commercial vehicles.

- Insurance providers are also focusing on sustainability and green initiatives, offering incentives for businesses that use eco-friendly vehicles or implement sustainable practices.

- The rise of autonomous vehicles and electric cars is reshaping the commercial auto insurance landscape, with insurers adapting their policies to cover new technologies and potential risks associated with them.

Progressive’s Position in the Market

- Progressive has positioned itself as a leader in commercial auto insurance by leveraging technology to provide innovative solutions and a seamless customer experience.

- Compared to other insurance providers, Progressive's focus on digital tools and personalized pricing sets it apart in the market, attracting businesses looking for tailored insurance solutions.

- With a strong emphasis on customer service and competitive pricing, Progressive continues to be a top choice for businesses seeking reliable commercial auto insurance coverage.

Final Thoughts

In conclusion, Progressive Commercial Auto Insurance emerges as a beacon of innovation and reliability in the insurance industry, setting a high standard for competitors to follow. As businesses navigate the ever-changing landscape of commercial auto insurance, Progressive stands ready to provide steadfast support and cutting-edge solutions for all their insurance needs.

Essential FAQs

What innovative tech solutions does Progressive offer for commercial auto insurance?

Progressive provides telematics devices that track driving behavior, usage-based insurance options, and AI-powered claims processing systems.

How does Progressive compare to other insurance providers in terms of customer service?

Progressive is known for its responsive customer support and efficient claims processing, setting it apart from competitors in the market.

What are the emerging trends in the commercial auto insurance sector by 2025?

By 2025, trends like increased adoption of connected vehicle technology, personalized insurance plans, and digital claims processing are expected to reshape the industry.