Exploring the world of Car and House Insurance Quotes: Are Bundles Always Cheaper? will uncover the intricacies of bundled insurance, shedding light on whether combining these policies truly leads to more savings.

Delve into the nuances of bundled insurance and discover the factors that play a crucial role in determining the cost-effectiveness of these packages.

Introduction to Car and House Insurance Bundles

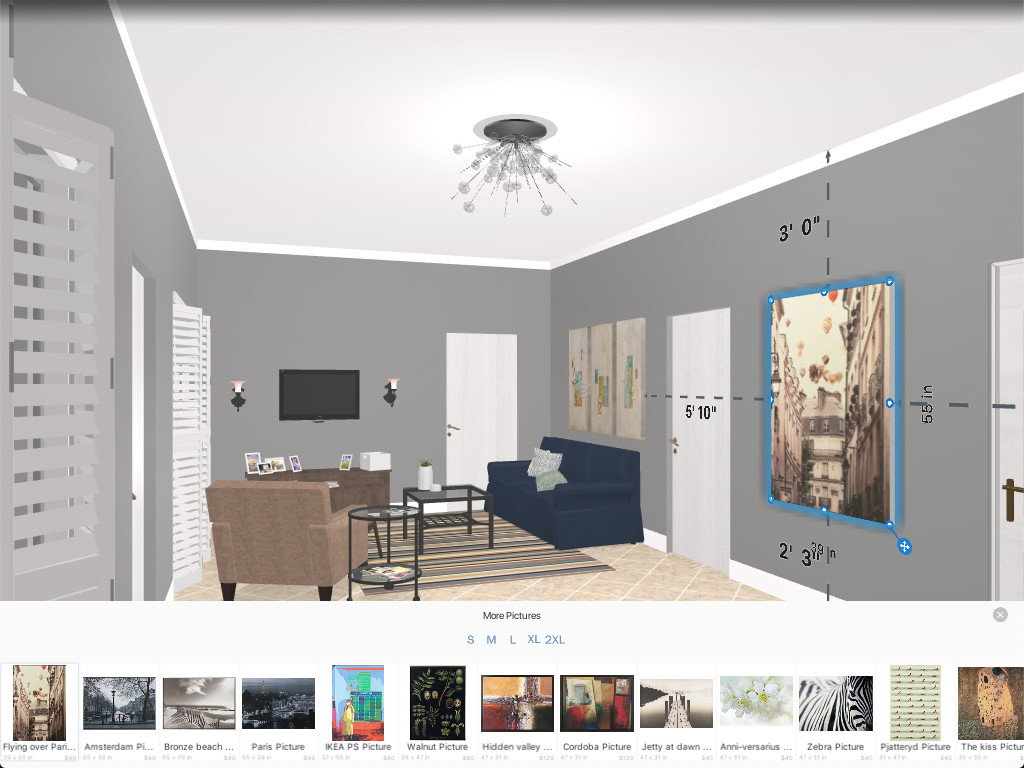

Car and house insurance bundles refer to the practice of purchasing both car insurance and homeowner's insurance from the same provider. This type of insurance package offers coverage for both your vehicle and your home, providing a convenient and cost-effective solution for your insurance needs.

Benefits of Bundling Car and House Insurance

- Cost Savings: Bundling your car and house insurance can often result in significant cost savings. Insurance companies may offer discounts or special rates for customers who choose to bundle their policies.

- Convenience: Managing your insurance policies becomes easier when you bundle them together. You only have to deal with one insurance provider for both your car and home insurance needs.

- Simplified Claims Process: In the event of a claim that involves both your car and home, having bundled insurance can streamline the claims process and make it more efficient.

Why People Consider Bundling These Insurances

- One-Stop Shop: Bundling allows customers to have a one-stop shop for their insurance needs, making it more convenient to manage and update policies.

- Discounts and Savings: Many insurance companies offer discounts for bundling, which can lead to cost savings over time.

- Consistent Coverage: By bundling, you can ensure that your car and home insurance policies are aligned and provide consistent coverage across both areas.

Factors Affecting Bundle Pricing

When it comes to bundled car and house insurance, several factors come into play that influence the overall pricing. Understanding these key factors can help consumers make informed decisions when selecting insurance packages.

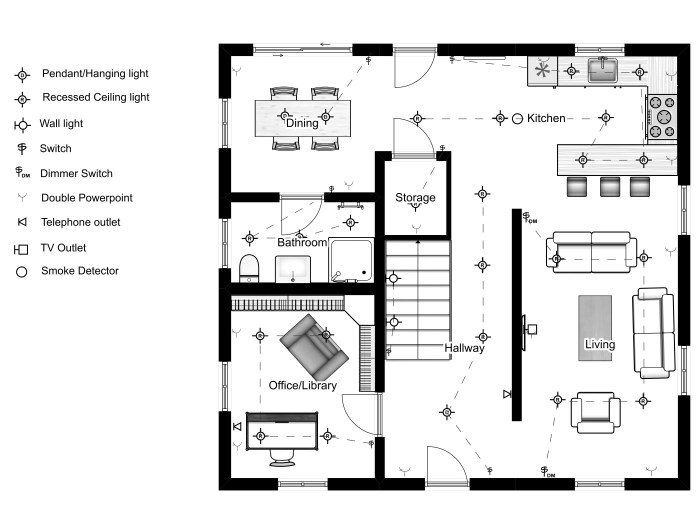

Value of the Assets

The value of the insured assets, such as the car and house, significantly impacts the pricing of bundled insurance. Higher valued assets typically require more coverage, which can result in higher premiums. Insurers take into account the replacement cost of the assets when determining the overall price of the bundle.

- Properties with high market values may require more coverage, leading to increased premiums.

- Cars with a high retail value or expensive features may also contribute to higher insurance costs.

- On the other hand, lower-valued assets could result in more affordable bundled insurance packages.

Location of the Insured Properties

The location of the insured properties plays a crucial role in determining the cost of bundled insurance. Certain geographic areas may be prone to higher risks, such as natural disasters or high crime rates, which can impact insurance premiums. Insurers consider the location of the properties when assessing the overall risk associated with the bundled coverage.

- Properties in areas prone to natural disasters, such as hurricanes or wildfires, may face higher insurance costs.

- Urban areas with higher crime rates could lead to increased premiums for both car and house insurance.

- Conversely, properties in low-risk areas may qualify for discounts, resulting in more affordable bundled insurance options.

Comparing Bundled vs. Separate Policies

When it comes to insurance, deciding between bundled policies or separate policies can have a significant impact on your overall costs and coverage

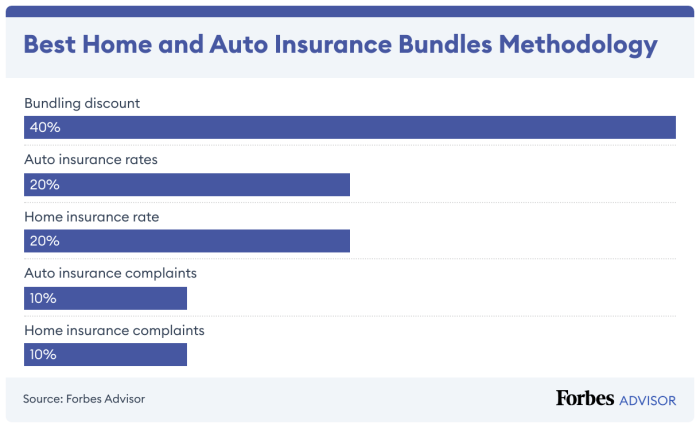

Cost Savings with Bundled Policies

When you bundle your car and house insurance policies together, insurance companies often offer discounts as an incentive. These discounts can result in significant cost savings compared to purchasing separate policies for each. For example, you may save up to 25% on your total insurance premium by bundling your policies.

Drawbacks of Bundling Policies

While bundled policies can save you money, there are some potential drawbacks to consider. One drawback is that you may have limited flexibility in choosing coverage options compared to separate policies. Additionally, if you need to make a claim on one policy, it could affect the premium or coverage of the other policy in the bundle.

Coverage Options in Bundled vs. Separate Policies

Coverage options differ between bundled and separate policies. With bundled policies, insurance companies often offer standardized coverage options that may not be as customizable as separate policies. In contrast, separate policies allow you to tailor coverage to your specific needs, but this flexibility may come at a higher cost.

Tips for Finding the Best Bundle Deals

When looking for the best deals on bundled car and house insurance, it's essential to consider a few key factors to ensure you're getting the most value out of your policy. From reviewing coverage limits to comparing quotes from different providers, here are some tips to help you find the best bundle deals.

Review Coverage Limits and Deductibles

- Before committing to a bundled insurance policy, carefully review the coverage limits and deductibles for both your car and house insurance. Ensure that the limits meet your needs and that the deductibles are reasonable and affordable.

- Consider any additional coverage options you may need, such as coverage for personal belongings in your home or roadside assistance for your vehicle. Make sure these options are included in the bundle or available as add-ons.

Compare Quotes Effectively

- Request quotes from multiple insurance providers to compare prices and coverage options. Be sure to provide the same information and coverage details to each provider for an accurate comparison.

- Look beyond the total price and consider factors such as customer service ratings, claims processing efficiency, and overall reputation when comparing quotes. The cheapest option may not always be the best value in the long run.

- Take advantage of online comparison tools and resources to streamline the quote comparison process and make an informed decision.

Closure

In conclusion, the discussion around Car and House Insurance Quotes: Are Bundles Always Cheaper? provides valuable insights into the world of insurance bundling, offering a comprehensive look at the pros and cons of opting for bundled policies.

Helpful Answers

Are bundled insurance policies always cheaper than separate ones?

Bundled insurance policies can often lead to cost savings due to discounts offered by insurance companies for combining multiple policies. However, individual circumstances may vary, so it's essential to compare quotes to determine the best option for you.

What are the potential drawbacks of bundling car and house insurance?

One drawback could be limitations in coverage options compared to separate policies. Additionally, if you no longer need one of the bundled policies, you might face complexities in adjusting your insurance.

How can I find the best bundle deals for car and house insurance?

To find the best bundle deals, consider shopping around, reviewing coverage limits, deductibles, and comparing quotes from different insurance providers. It's also advisable to consult with an insurance agent to explore all available options.